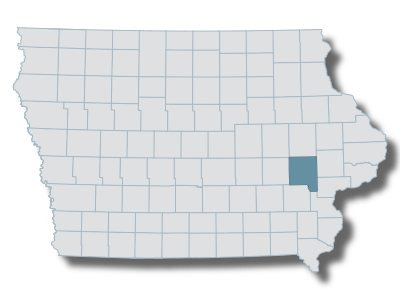

Johnson County Treasurer

Scott Finlayson

Took Office:

January 03, 2023

We recommend you pay your property and vehicle renewal (tag) taxes online. It's easy, fast and safe. Online payment options include Discover Card, MasterCard, Visa, American Express and eCheck - an electronic transfer of funds from your bank account to the County bank account.

Johnson County Office Information

Send an email

Phone Number

Property Tax Division: 319-356-6087

Motor Vehicle Division: 319-356-6091

Fax: 319-337-0495

Location

Johnson County Treasurers Office

913 S Dubuque St

Iowa City, Iowa 52240

Hours

Monday - Friday 8:00 a.m. to 5:00 p.m.

Please be in the office by 4:30 p.m. for title transfers!

Mailing Address

Johnson County Treasurers Office

913 S Dubuque St

P O Box 2420

Iowa City, Iowa 52244-2420

Website

Office Staff

County Treasurer - Scott Finlayson

Lead - Kathy Pierce

Motor Vehicle Deputy - Margarita Flack

Property Tax and Accounting Deputy - Robert Black

Holidays

The Treasurer's Office is closed for the following county observed holidays:

2023

- Labor Day - Monday, September 4, 2023

- Veteran's Day - Friday, November 10, 2023 (Observed)

- Thanksgiving Day - Thursday, November 23, 2023

- Friday after Thanksgiving - Friday, November 24, 2023

- Christmas Eve Day - Friday, December 22, 2023 (Observed)

- Christmas Day - Monday, December 25, 2023

- New Year's Day 2024 - Monday, January 1, 2024

Property Tax

The County Treasurer collects and distributes the property taxes and prepares reports for the State Treasurer, maintains bank accounts for the various county funds and conducts tax sales on property for which the taxes have not been paid.

Tax Sale

The annual tax sale is held generally on the third Monday of June starting at 8:00 AM. To participate in the tax sale, a bidder must pre-register with our office as outlined in the tax sale rules. See the Johnson County website for more information on the annual tax sale.

Property Tax Statements

Annual property tax statements are mailed once a year. Your property tax payment may be paid in one full installment or two half installments. The first half is due on September 1 and becomes delinquent after September 30. The second half is due March 1 and becomes delinquent after March 31. The current tax statements are also available on the Johnson County website.

Search for your Property Tax Statement

Property Tax Forms

Browse common Property Tax related forms Property Tax Forms

Vehicle Renewals

The County Treasurer's office is home to the Motor Vehicle department where you can register and title your car or other motorized vehicles.

Do you have old license plates to dispose of? Let us recycle them for you. We have a license plate drop box in front of our building.

Important Notice: The Motor Vehicle department is NOT where you get your driver's license.

The Iowa State Department of Transportation Driver's License office is located at:

2303 Jones Blvd.

Coralville, IA 52241

(319) 338-5294

Order Personalized and Specialty Plates Online

The Iowa DOT website allows you to personalize your license plate, check availability, and reserve it. If it is available and approved, your plates will be manufactured and delivered to the county treasurer's office in the county where you live. You will be notified when the plates are ready to be picked up.

Personalized and Specialty Plates

New Residents Info

Iowa law requires you to register your motor vehicle with the county treasurer's office in your county within 30 days from the date you establish residency. Iowa registration is required even though your license plates may still be valid in another state.

The following documents are required to be surrendered to the county treasurer's office:

- Your current ownership document (certificate of title). Must be the original or an official duplicate of the certificate of title. The State of Iowa does not accept copies.

- A completed application for an Iowa certificate of title and/or registration. The application must be signed by all owners. If there is a lien against the vehicle, it should be noted on the application. You will want to contact your county treasurer's office for amount of registration fees. In Johnson County, the Treasurer's office phone number is: 356-6091.

If you move from one county to another, you must report your change of address to the county treasurer in your former county of residence within ten days after your move so your motor vehicle registration information can be forwarded to the county where you now live.

Vehicle Forms

Browse common Title/Registration and related forms Vehicle Forms

Driver's License Services

123